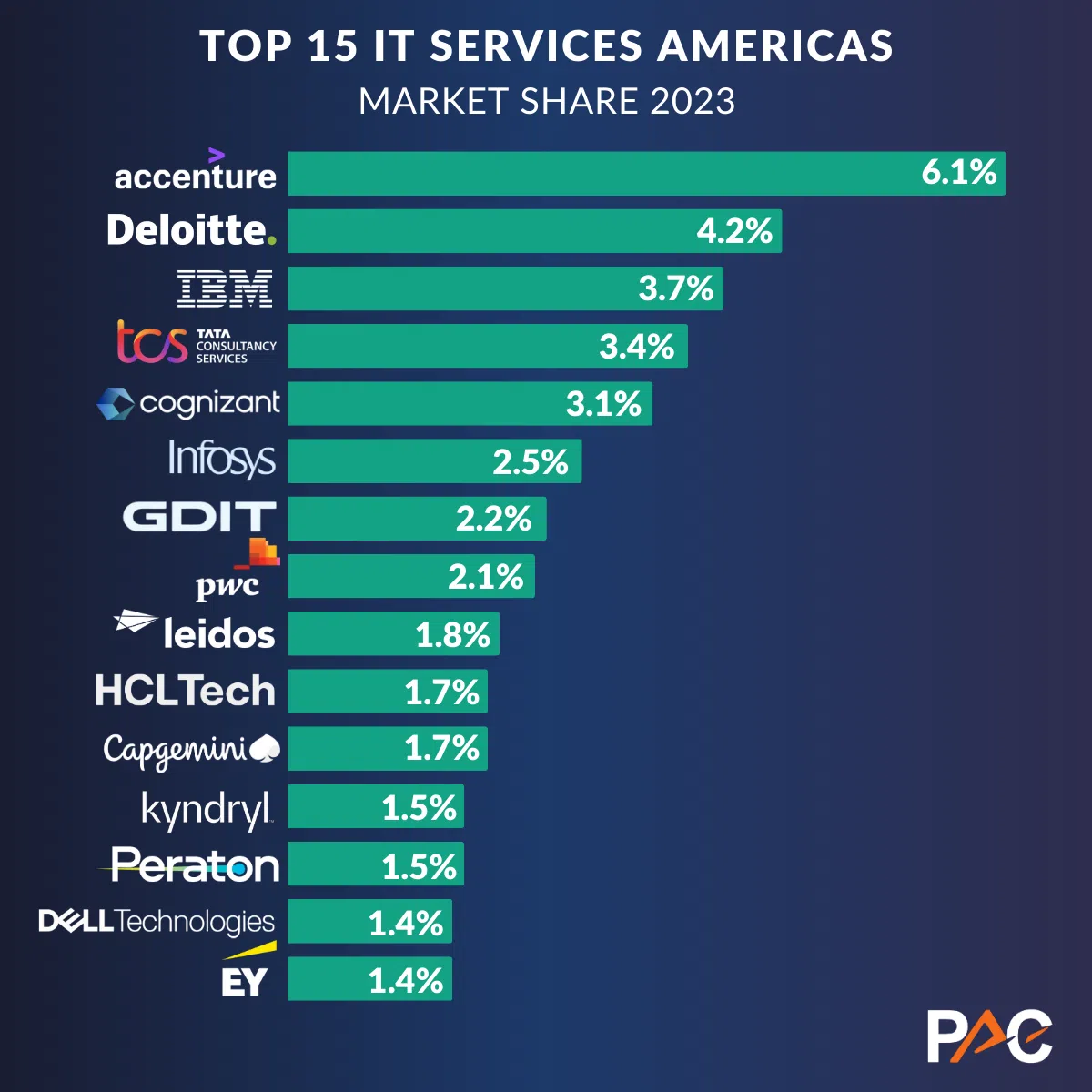

Top 15 IT Services in Americas

Accenture, Deloitte and IBM confirm their leadership, Deloitte and EY fastest growing

PAC published last week its first vendor rankings by 2023 IT services revenue in Americas. No change in the Top 9 - yet a few interesting moves below! Moreover the vendors reported quite inhomogeneous performance.

Accenture remains the undisputed leader on the American IT Services market, 45% bigger than its next challenger. Accenture's IT service revenue grew 2% in Americas in 23 (+20% in 22), with growth progressively slowing down along the year (+5% in Q1, +2% in Q2, +1% in Q3 and -1% in Q4). Like most of its peers, Accenture suffered from very tough market conditions in banking, telecom and technology and from the massive slow-down of the cloud business.

Deloitte managed to close the gap, with +13% in 23 (+20% in 22). Similar to its peers (PwC, EY and KPMG), Deloitte was less impacted by the end of the major cloud transformation programs conducted in 21 and 22. On the one hand, the big 4 are less focused on big deals, on the other they are late entrants on (hence less dependent from) the cloud market. By comparison, their business is more focused on the large ERP platforms and they took advantage of the acceleration in SAP and Oracle transformations. Finally, the big 4 are privately held and as such not submitted to stock exchange expectations of short terms savings when market conditions deteriorate; while the big IT services vendors raised the pressure on their staff and conducted some lay-offs programs, the big 4 took advantage of the situation to reinforce their skills in selected segments.

IBM grew its IT services revenue by 2% in 23 (+9% in 22), with strong growth in the Consulting unit (Consulting, SI, Managed Services) offset by a substantial decrease in the Infrastructure Support business. IBM Consulting reported quite stable growth along the year.

TCS grew 3% in 23 (+19% in 22), with growth slowing down along the year (+10% in Q1, +5% in Q2, flat in Q3, -3% in Q4). Cognizant decreased 1% in 23 (+6% in 22) with a consistent (weak) performance along the year (-1% in Q1, -2% in Q2, -1% in Q3, -2% in Q4). Infosys grew 1% in 23 (+15% in 22), again with growth slowing down (+6% in Q1, +2% in Q2, +1% in Q3, -5% in Q4).

General Dynamics Information Technology reported 3% in 23 (+1% in 22), PwC grew +7% (23% in 22), Leidos reported 7% (+5% in 22). GDIT and Leidos (like Peraton below) benefited from the healthy public sector & defense market.

HCL and Capgemini fight for the 10th place. Including BPO and/ or engineering services, HCL leads; including management consulting, Capgemini leads. However the 23 performances were quite different: while HCL grew 7% in 23 (+9% in 22), won 3 places and managed a stable growth (+10% in Q1, +7% in Q2, +4% in Q3, +7% in Q4), Capgemini reported a 1% decrease (+14% in 22) with a continuous slow down (+6% in Q1, flat in Q2, -4% in Q3, -7% in Q4).

Kyndryl decreased 5% in 23 (-3% in 22), Peraton grew 6% (+6% in 22), Dell decreased 10% and finally EY grew 13%, thus entering the top 15.

Behind, 7 vendors fight for a place in the Top 20: NTT Data, Wipro, Oracle, CACI, DXC, CGI and KPMG.

Notes:

- The USA generate 89% of the American IT services market. And for all the vendors in the top 15, the USA generated 90+% of the Americas revenue.

- For this ranking we considered IT services excl. BPO. Including BPO, 3 BPO specialists would enter the top 15: ADP (ranking 6th), Fiserv (7th) and FIS (11th); yet all 3 operate on very specific BPO markets (payroll & HR for ADP; payment for Fiserv and FIS).

More details for our SITSI customers here "Software and IT Services - Preliminary Vendor Rankings Calendar Year 2023 - Americas"

0 thoughts on "Top 15 IT Services in Americas"