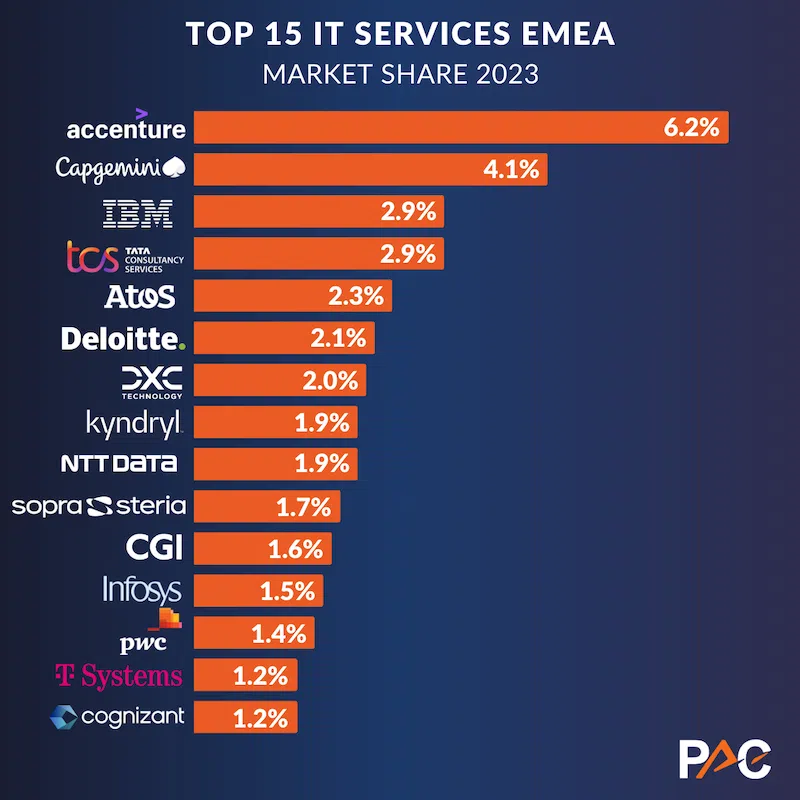

Top 15 IT Services EMEA

Accenture and Capgemini confirm their leadership, Sopra Steria and Deloitte fastest growing

PAC published last week its first vendor rankings by 2023 IT Services revenue in EMEA. No change in the Top 5 - yet a few interesting moves below! Moreover the vendors reported quite inhomogeneous performance by country.

Accenture remains the undisputed leader on the European IT Services market, 50% bigger than its next challenger. Accenture's IT service revenue grew 5% in EMEA, with strong growth in France, Germany and Italy offset by weakness in the UK.

Capgemini secured its 2nd place, slightly reducing the gap with 6% growth in EMEA. Capgemini's growth was highest in Germany and the UK, average in France and the Netherlands, weaker in the Nordics. Note: also considering engineering services (Altran's heritage) the gap to Accenture is down to 40%.

IBM grew its IT services revenue by only 1% in EMEA, with stronger growth in the Consulting unit (Consulting, SI, Managed Services) offset by a substantial decrease in the Infrastructure Support business. IBM services' growth was highest in the UK and Germany, weaker in Italy, Benelux and the Nordics.

TCS grew 7% in EMEA, with 13% growth in the UK (generating more than 50% of European revenue) contrasting with +3.5% in Continental Europe.

Atos (-2%) secured its 5th place, with 3% organic growth more than offset by disposals (in particular the Italian unit sold to Lutech; Reminder: in 2007, prior to the SIS acquisition, Atos sold its Italian business to Engineering) and ramp downs (in particular a major UK BPO contract). On an organic basis, Atos grew substantially its Eviden business (application services), especially in Germany, while Tech Foundations (infrastructure services) contracted slightly.

Deloitte (+12%) won 2 places with impressive growth in Germany and Italy, average in the UK and France (which has remained a challenging market for Deloitte), weaker in the Netherlands.

DXC (-7%) lost once place, with slight growth in GBS (application services) more than offset by contraction in GIS (infrastructure services); Kyndryl (-2%) also lost one place.

NTT Data (+6% on a proforma basis; for the first time together with NTT Ltd) is the newcomer in this Top 10. The strong growth in the "historical" NTT Data business (mainly application services) was partly offset by a slight decrease in the NTT Ltd business (infrastructure services).

Sopra Steria (+14%) reported the fastest growth within our top 10 this year, thanks to substantial organic growth (+7%), highest in the UK, Nordics and Spain, while moderate in France, combined with the impact of substantial acquisitions both in 22 (CS in France) and 23 (Ordina in the Benelux).

CGI (+6%) reported strong growth in France (though not only organic), the UK and Germany, while growth was weaker in the Netherlands and Sweden.

Infosys (+8%; overperforming in Germany), PwC (+11%; driven by the UK and Germany), Deutsche Telekom/ T-Systems (+10% thanks to strong performance in Germany and Spain) and Cognizant (+2%; will probably lose its place in this Top 15 to EY in 2024) complete the Top 15.

Behind, 6 vendors fight for a place in the Top 15: EY, Wipro, Fujitsu, Orange, KPMG and HCL.