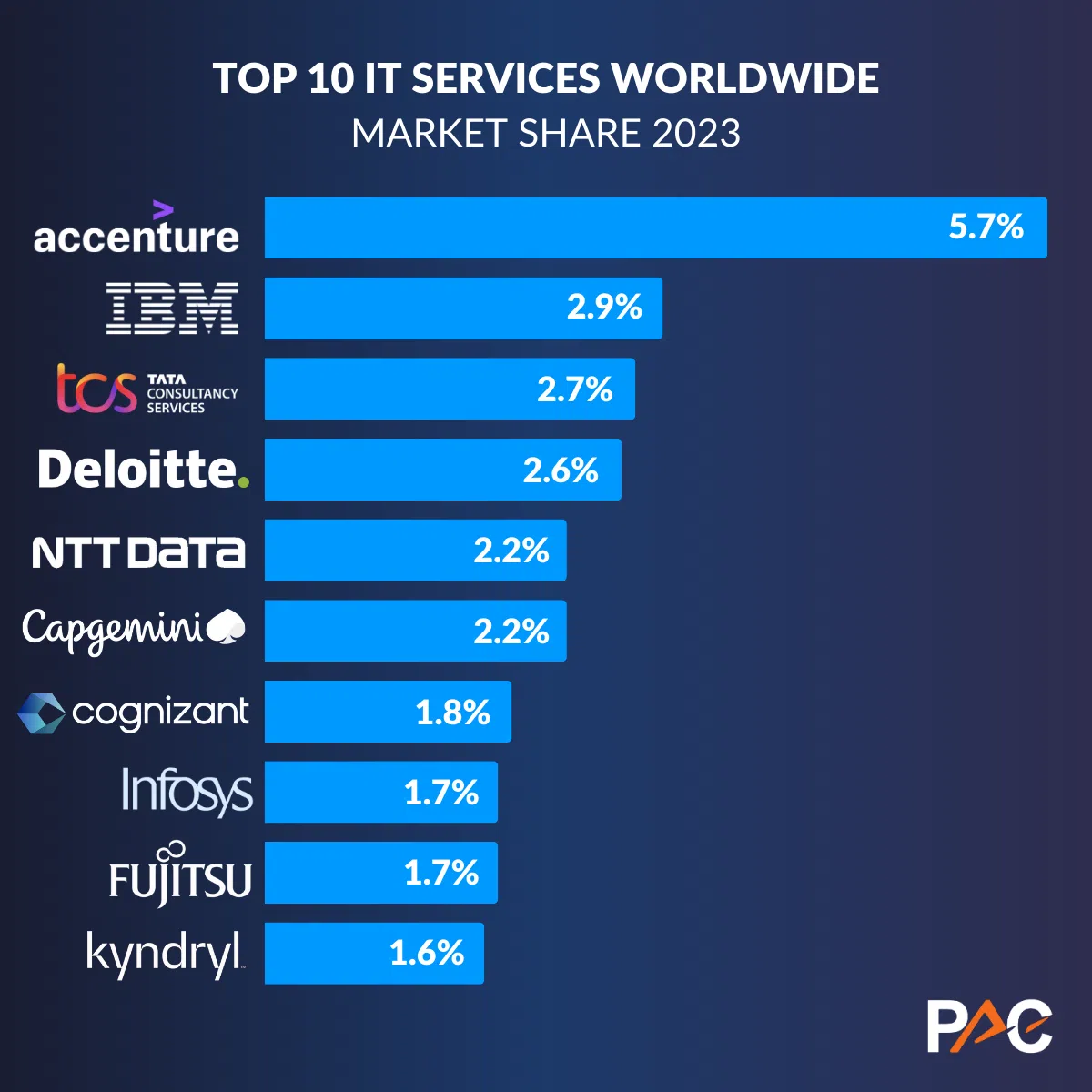

Top 10 IT Services Worldwide - Accenture confirms its leadership, NTT Data enters the Top 5

PAC published yesterday its first vendor rankings by 2023 revenue. No change in the Top 4 - yet quite a few below!

Accenture remains the undisputed leader on the IT Services market, twice as big as its next challenger. Accenture's IT service revenue grew 5% in local currency (+2% in €, +4% in $), with +5% in EMEA in € and +2% in Americas in $.

IBM secured its 2nd place with +1% in local currency (-1% in €, +1% in $), with -1% in EMEA in € and +1% in Americas in $. IBM Consulting did much better (+6% in local currency); yet, considering IBM Consulting only, IBM would fall out of the top 5.

Tata Consultancy Services closed the gap, growing 5.5% in local currency (+2% in €, +5% in $), with a robust +7% in EMEA in € and +2% in Americas in $.

Deloitte is the main winner in this Top 10 with +14% in local currency (+13% in €, +15% in $), with an impressive +12% in EMEA in € and +16% in Americas in $!

The new entrant in this Top 5 is NTT DATA, following the integration of NTT Ltd. While IBM decided to spin off Kyndryl and Atos to split the company in Eviden and Tech Foundations, NTT Data did the contrary - with the aim to develop synergies between the infrastructure and the application businesses. On a proforma basis, NTT Data grew 5% in local currency (-1% in €, +2% in $), with a strong +10% in EMEA in €, -1% in Americas in $ and remarkable +8% in Japan in ¥.

This kicks Capgemini out of the Top 5, in spite of a reasonable 4.5% growth in local currency (+3% in €, +5% in $), with a robust +6% in EMEA in € and -1% in Americas in $. Note: This year we published new vendor rankings including management consulting and engineering services; there, Capgemini remains 5th.

Cognizant was flat in local currency (-3% in €, flat in $), with +2% in EMEA in € and -1% in Americas in $, also losing one place.

Infosys won 2 places, growing 3% in local currency (+1% in €, +3% in $), with a strong +8% in EMEA in € and +1% in Americas in $.

Fujitsu secured rank 8th, growing 4% (-6% in €, -3% in $), with -3% in EMEA in €, -8% in Americas in $ and remarkable +7% in Japan in ¥.

Kyndryl lost 2 places, shrinking 4% in local currency (-6% in €, -4% in $), with -2% in EMEA in €, -4% in Americas in $ and will probably leave the Top 10 in 2024. PwC will certainly replace them. Behind, 6 vendors fight for a place in the Top 15: DXC Technology, Atos and Wipro (all 3 with decreasing revenue in 23) compete with EY, HCLTech and CGI (all 3 with growing revenue).

More details for our SITSI customers here