Top 10 IT service providers in Switzerland

The Swiss IT services market, notwithstanding the country’s relatively small size, is one of the most important IT markets in Europe due to the presence of a large number of multinationals, complemented by an even more significant number of upper midsize companies and SMBs. According to PAC, the IT services market is expected to generate total revenues of approximately CHF 12 billion in 2022, corresponding to an increase of about 4% YoY.

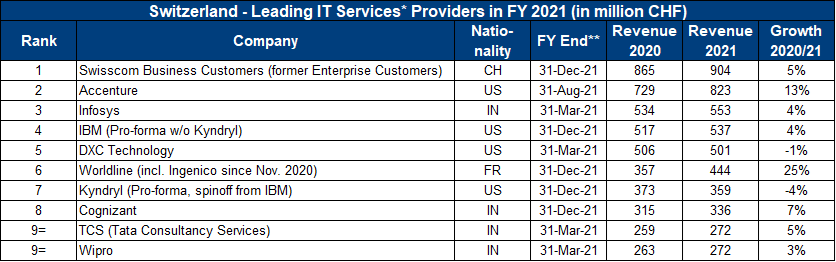

Today, the Swiss IT services market is primarily dominated by global providers, as is evident from our most recent top 10 ranking; nearly all top 10 companies are headquartered outside Switzerland. These IT service providers boast certain advantages and local sweet spots, which are presented below.

Swisscom Business Customers is the only local provider in our top 10 ranking. The company has a strong footprint in the banking industry and the infrastructure and application services segments. In addition, Swisscom operates one of the largest SAP practices in the country. The company’s USP is undoubtedly its “Swissness”, which is particularly helpful with locally oriented SMBs and large companies that prefer on-site services over offshore delivery.

US-based companies include Accenture, IBM, DXC, and Kyndryl.

Accenture stands out through its strong innovation-led business orientation. The company’s strong digital design and marketing expertise is also likely to positively impact its capability to help clients with their digital journeys. Moreover, Accenture extended its local presence with the acquisition of Swiss Trivadis and Swiss-German Wabion in 2021.

A critical IT services pillar for IBM Switzerland is the SAP business (SAP S/4HANA migration, etc.). In February 2022, the companies jointly announced an expansion of their global partnership, which also affects Switzerland. IBM became a RISE with SAP partner, and SAP customers can now also move SAP workloads to IBM’s public cloud.

Kyndryl, an IBM spin-off, focuses on infrastructure-related services and intends to expand its offerings around public cloud hosting services and public-cloud-related C&SI beyond IBM’s public cloud services. It has already announced partnerships with Microsoft, AWS, SAP, and VMware to this end.

DXC is another US-based services provider with a large footprint in Switzerland. Compared to other business-application-related services, such as SAP-related services, it is the ServiceNow business that stands out strongly at DXC Switzerland. Here, SBB, Roche, and Nestlé are some notable customers. DXC leverages ServiceNow technology to expand service management capabilities across various business operations, spanning IT, security operations, customer service management, and human resources service delivery.

Moreover, some India-heritage companies have been able to establish a strong footprint in the country, as large Swiss enterprises have been quite open to leveraging offshore resources. However, in our view, physical proximity to customers is still crucial to succeed in Switzerland, especially in terms of achieving local visibility, brand awareness, and access to the Swiss SMB market. This is why the majority of India-heritage providers continue to invest in local resources. Some of them also aim to extend their local footprint through strategic acquisitions (e.g., Wipro recently acquired Capco; Infosys acquired Lodestone back in 2012).

Infosys, for example, was able to double its local headcount over the last 18 months to approx. 600 people. In Switzerland, Infosys has strong engagements with large Swiss manufacturers (incl. life science). Three years ago, the company bundled its local vertical expertise and opened its Turbomachinery & Propulsion center in Swiss Baden, helping manufacturers with their servitization journeys.

At Cognizant, application-related services around core business platforms such as SAP (e.g., C&SI, application hosting and management at large financial institutions and pharmaceutical companies) and Salesforce (e.g., at large life science companies) are high on the agenda.

TCS has established a strong footprint in the Swiss life science industry. Moreover, for TCS, offering proprietary software (e.g., TCS BanCs) is essential. TCS even selected Switzerland as headquarters for Financial Solutions DACH to develop its financial product business (e.g., TCS BanCs) in the region.

TCS shares the 9th place in our ranking with Wipro. Wipro benefits from long-term infrastructure contracts with large companies. For instance, in February 2022, Wipro announced that it had won a five-year engagement with ABB Information Systems to provide digital workplace services for their 100,000+ employees spread over various countries.

In addition to Swisscom, US-based providers, and India-heritage players, Worldline also made it into the top 10. Worldline plays a somewhat special role in that it focuses almost exclusively on BPO services for banks and thus only competes in a few areas with the other providers on the list.

Right now, the current shortage of local consultants is preventing IT service providers from exploiting the full business potential in Switzerland. Another growth barrier some of the providers are faced with are customers’ budgets, which have come under growing pressure as a result of the challenging global macroeconomic environment. The impacts of the COVID-19 pandemic are still being felt, as are the associated supply chain issues. Moreover, the war in Ukraine is also prompting some customers to be more cautious. Nevertheless, IT service companies continue to have an optimistic business outlook for 2022, which is also reflected in our local market figures.