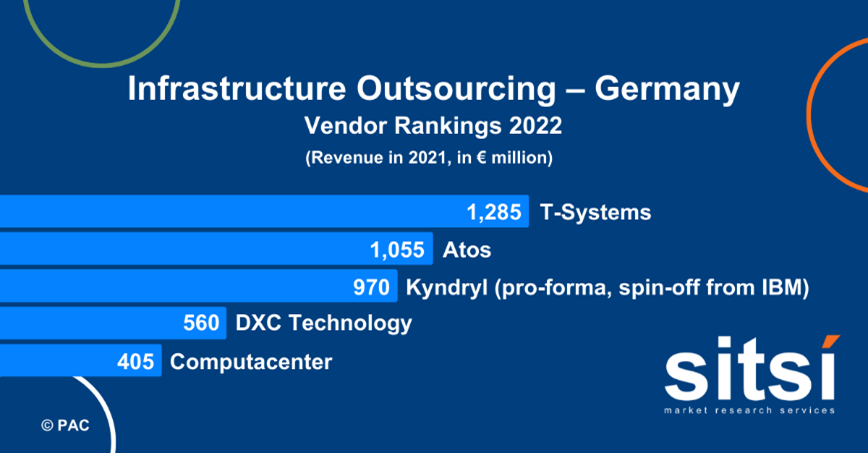

The leading infrastructure outsourcing and managed services providers in Germany

The public cloud market has been experiencing massive growth for years and has put considerable pressure on established IT outsourcing providers. But it has also created new growth areas for the services ecosystem.

PAC’s Infrastructure Outsourcing market segment comprises hosting and managed services for legacy and private cloud data centers and end-user devices, but also managed services for third-party public cloud platforms.

The individual market segments show very different dynamics. While the market for legacy server and workplace operations has been shrinking steadily, managed services for public cloud platforms continue to grow at a clear double-digit rate. Also, hosting and managed services for private clouds remain a relevant market, as most organizations run hybrid IT architectures. The detailed figures can be found in our cloud datamarts.

How is the outsourcing provider landscape evolving in Germany?

As can be seen in our recently published vendor rankings for Germany, in 2021, this segment was still largely dominated by the same players as 10 years ago – even though company names and ownership changed due to ongoing consolidation, and most recently, de-consolidation:

10 years back

T-Systems has remained the leader over the years, not least thanks to its massive SAP and private cloud hosting business.

Already back in 2011, Atos made a big leap in this ranking thanks to the acquisition of Siemens IT Solutions and Services, and has gained further market share since.

2021’s DXC Technology comprises two top 10 infrastructure outsourcing players from 2011, HPE’s services unit (which back then already comprised the “inventor” of IT outsourcing, EDS) and CSC.

Even Atos’ recently announced plans to spin off its high-growth business areas into a new company, Evidian, will probably not immediately impact Atos’ top 3 position.

However, it competes with the already spun-off Kyndryl, which more or less continues former IBM’s infrastructure outsourcing business, for the second place in the ranking.

10 years forward

When looking ahead at the next 10 years, it is rather unlikely, though, that we will see the same players, or even their successors, in 2031.

Even though all currently leading players have massively “cloudified” their business models over the past few years, their fast-growing managed public cloud business and their still relevant hybrid cloud services will not fully compensate for the decline of legacy outsourcing.

Among the top 5 players, only Computacenter grew at all in 2021, by an estimated 4%, while all the others shrank.

We clearly saw the greatest dynamics in 2021 among vendors without a huge legacy infrastructure business but with a clear focus on public-cloud-related services; providers like Accenture, Infosys, Capgemini, and TCS all recorded double-digit growth in PAC’s “Infrastructure Outsourcing & Managed Services” market in Germany. This shift will continue – in the market and on the provider side.

Vendor Landscape: IT infrastructure operations providers in Germany

A comprehensive overview of the positioning and strategic development of the relevant providers in Germany can be found in our InSight Analysis “Cloud Vendor Landscape: IaaS/PaaS Operations Services in Germany”.